Unraveling the True Cost of Currency Conversions: The Hidden Impact on Your Business

Currency conversions constitute a substantial part of many businesses' cost structure, comparable to other essential expenses like staff salaries, rent, or utility bills. However, what often eludes businesses is the genuine cost of these currency conversions, concealed by the constant fluctuations in exchange rates. In this blog post, we aim to unveil the hidden costs associated with currency conversions and provide insights into how businesses can optimize their strategies to achieve significant cost savings.

Understanding Exchange Rates: The Moving Target

Exchange rates are in a constant state of flux, influenced by various economic factors, geopolitical events, and market sentiment. While customers are aware of the dynamic nature of these rates, what often goes unnoticed is the margin charged by banks or brokers. This margin, commonly referred to as the spread, represents the hidden cost that can erode profits without businesses even realizing it. The higher your margin, the more you lose money off your balance sheet, and the more you add it onto your bank or broker's, irrespective of how much exchange rates fluctuate.

The Obscured Margin: How Banks and Brokers Profit

Banks and currency brokers add a margin to the interbank exchange rate when providing currency conversion services. This additional margin serves as their profit, and it's where businesses might be unwittingly losing money. The challenge lies in the fact that customers often focus on the changing exchange rates, overlooking the impact of these margins on the overall cost of the transaction. Due to the ever-fluctuating nature of exchange rates, what many businesses fail to do is look at the margin they are being charged as a very real and quantifiable cost to their business, a cost that can very likely be reduced and in many cases very significantly. The fluctuating nature of exchange rates often leads to businesses believing the cost of their currency conversions are "just one of those things" and solely dictated to them by factors completely out of their control. The actual reality is a large part of the cost is something they can easily quantify, measure and reduce, just like any other cost their business has to cover.

Your spread and market fluctuations represent two separate costs to your business; they need to be uncoupled from each other and managed and measured in different ways:

Calculating the True Cost: Revealing the Margin

To unveil the true cost of currency conversions, businesses need to scrutinize the margin applied by their bank or broker. Understanding how to calculate this margin and recognizing its influence on transactions is crucial. Armed with this knowledge, businesses can make more informed decisions about where and how to conduct currency exchanges, and if they are currently receiving fair value from their bank or broker for the service they provide.

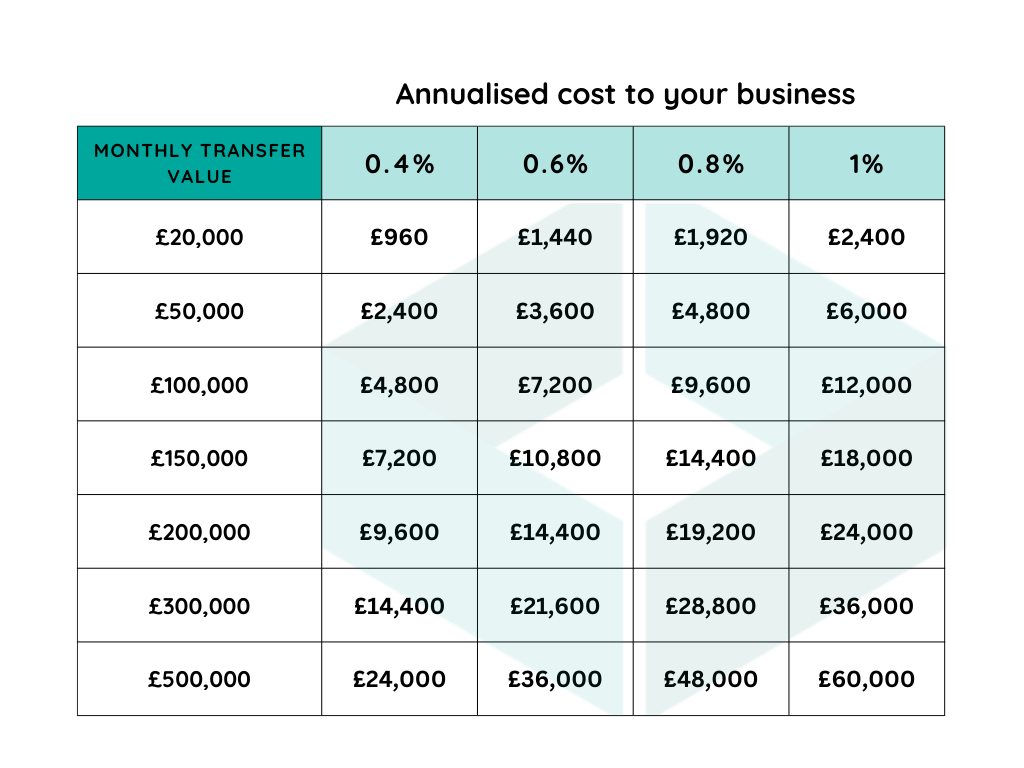

Below is a table representing the true cost to your business of different spreads or margins on different annual exposures of foreign exchange conversions:

To help quantify the cost of FX to your business and determine if you are getting good value, let's momentarily suspend reality. Imagine your business needs to purchase a fixed amount of USD in a year, and currency rates no longer fluctuate—the GBP/USD exchange rate is locked at 1.25 and remains constant. This eliminates the variable element from your costs, allowing you to focus on the hidden cost for each conversion. Consider the example from the table above, where a business converts £200,000 per month into USD at a margin of 0.6%. The annual cost for their currency conversions is £14,400, which means that at a fixed exchange rate of 1.25, they achieve a rate of 1.2425 on every conversion. If they could attain a rate of 1.25 themselves, they would save their business £14,400 per year. By reducing their margin to, say, 0.1%, they could save their business £12,000 annually.

Now, let's return to reality, and exchange rates resume fluctuating as usual. In the scenario described, it becomes inconsequential whether your average exchange rate for the year is 1.50 or 1.15. The cost to your business for conversions remains £14,400 for the margin aspect. Regardless of whether your average rate is higher or lower than the previous year, reducing your margin directly reduces the cost to your business, irrespective of how exchange rates behave. If you pay more for your currency because the GBP/USD rate drops (the cost of market fluctuations) the margin aspect of your costs, the £14,400 per year, could still be reduced by reducing your margin to something more competitive.

The table below highlights how much your business could save per year, by reducing your current spread or margin, based on your annual FX exposure and current margin, irrespective of the direction in which exchange rates move:

Comparing Costs: Why Every Percentage Point Matters

Even seemingly small differences in margin percentages can accumulate into significant costs over time. By comparing the costs associated with different banks or brokers, businesses can identify opportunities to reduce expenses and increase overall profitability. This comparative analysis empowers businesses to choose providers that offer competitive margins, ensuring they are not paying more than necessary for currency conversions.

Currency Margins: The Uncomfortable Truth

The international payments industry is now a very mature and heavily commoditized sector, where hundreds of providers can effortlessly offer identical services to clients. In this landscape, the prevailing reality is that the margins charged by many brokers, and notably by banks, are often excessively outdated given the industry's evolution. With an abundance of providers offering comparable services, the traditional approach of imposing high, ever changing and untransparent margins is completely out of sync with market dynamics.

The ease with which clients can access similar services from different providers underscores the need for a reevaluation of margin structures within the industry. They should, in fact, be far lower to align with the contemporary landscape and better serve the interests of businesses and consumers alike.

Using the example above of a business buying £200,000 of USD per month, no business should be charged a margin of 0.6% or more on an FX turnover of that size, it is simply not fair value in such a competitive market.

Take Back Control: Know Your Margin

Every business that has the need to make currency conversions should know the exact margin they are being charged. You wouldn't go into a shop and buy an expensive item or buy a car from a dealership without knowing the price in advance, and every currency conversion you make should be no different. Your margin should be agreed upon at the outset, and it should never be changed for the worse. It should also be completely transparent, with every trade confirmation showing the live interbank rate at the time and the rate you achieved. Unfortunately, it is a common practice for many brokers to offer attractive rates initially and then gradually widen their margin over time. This is equivalent to buying a high-ticket item blindly and leaving yourself at the mercy of the sales assistant regarding the final cost.

If you do not know your margin, there is an extremely high probability you are being massively overcharged for your currency conversions and paying more than necessary. Essentially, your bank or broker is taking money that could be on your balance sheet and adding it to their own instead. If you do not know your margin, it also makes it impossible to quantify how much you could save by shopping around. If a new broker offers you 0.2%, will that save your business nothing, or could it save your business £20,000 per year?

If it turns out that you could save a substantial amount of money for your business by opting for an alternative broker, the question to ask yourself is not whether you are content or happy with your current broker (given that, if you were dissatisfied, you would have sought an alternative by now). The fundamental questions to ask yourself are:

- Are you genuinely satisfied with their services to the extent that you're willing to consistently pay a significant premium for each currency conversion?

- Does their offering truly validate the considerable premium, or could the money saved be more impactful if invested elsewhere in your business?

- What specific benefits do you currently receive from the relationship that justifies the elevated cost, and do you perceive it as fair value?

- While you may get on well with a particular individual at your bank or broker, is this relationship worth the substantial annual cost to your business?

- if you primarily conduct transactions online, is it worth paying a premium for the service, when identical or even improved services are available elsewhere at significantly lower cost?

The Long-Term Impact: Continuous Savings and Financial Stability

By actively managing and minimizing currency conversion costs, businesses position themselves for long-term financial stability. The savings accrued over time contribute to improved profit margins, enhanced competitiveness, and a more resilient financial foundation.

Conclusion

The ever-fluctuating nature of the foreign exchange market means the true cost of currency conversions often eludes the scrutiny it deserves. Recognizing the obscured margins imposed by banks and brokers is the first step toward optimizing currency exchange processes. By understanding the real cost of their currency conversions, businesses can save significant sums of money without making any compromises on the service they receive.

It is imperative you know exactly what you are being charged for your currency conversions so that you can quantify the cost, decide if you are currently receiving fair value for that cost from your current provider, and make meaningful comparisons to other providers to see if you can significantly reduce the cost of your conversions.

/ +44 (0) 208 004 2234

info@cornerstonefx.co.uk

UK Headquarters: 85 Great Portland Street, London, W1W 7LT

Email: info@cornerstonefx.co.uk

Cornerstone FX Ltd is a Limited company registered in England and Wales. Registered number: 12736110. Registered office: 85 Great Portland Street, London, W1W 7LT. Payment services for Cornerstone FX Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: The Steward Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited are fully authorised and regulated in the UK, EU, US, and Canada – Currencycloud are authorised and regulated by the FCA, registration number 900199, and FinCEN in 44 states. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). In the US Currency Cloud operates in partnership with CFSB. CFSB fully owns the bank program and services are provided by The Currency Cloud Inc. For clients based in the European Economic Area, payment services for Cornerstone FX are provided by CurrencyCloud B.V.. Registered in the Netherlands No. 72186178. Registered Office: Nieuwezijds Voorburgwal 296 - 298, Mindspace Nieuwezijds Office 001 Amsterdam. CurrencyCloud B.V. is authorised by the DNB under the Wet op het financieel toezicht to carry out the business of an electronic-money institution (Relation Number: R142701). For clients based in the United States, payment services for Cornerstone FX are provided by The Currency Cloud Inc. which operates in partnership with Community Federal Savings Bank (CFSB) to facilitate payments in all 50 states in the US. CFSB is registered with the Federal Deposit Insurance Corporation (FDIC Certificate #57129). The Currency Cloud Inc is registered with FinCEN and authorised in 39 states to transmit money (MSB Registration Number: 31000206794359). Registered Office: 104 5th Avenue, 20th Floor, New York , NY 10011.

For clients based in the United Kingdom and rest of the world, payment services for Cornerstone FX are provided by The Currency Cloud Limited. Registered in England and Wales No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). Some Payment Services for Cornerstone FX Ltd may also be provided by Equals Connect Limited, registered in England and Wales (registered no. 07131446). Registered Office: Vintners’ Place, 68 Upper Thames St, London, EC4V 3BJ. Equals Connect Limited are authorised by the Financial Conduct Authority to provide payment services (FRN: 671508) Some payment services for Cornerstone FX Ltd may also be provided by Sciopay Ltd. Sciopay Ltd is a company incorporated in England & Wales. Registration No: 12352935. Sciopay Ltd is licensed and regulated by HMRC as a Money Service Business (MSB). License No: XCML00000151326. Sciopay Ltd is authorised by the Financial Conduct Authority as an Authorised Payment Institution. Firm Reference Number: 927951