/ Low cost, low friction

international payments

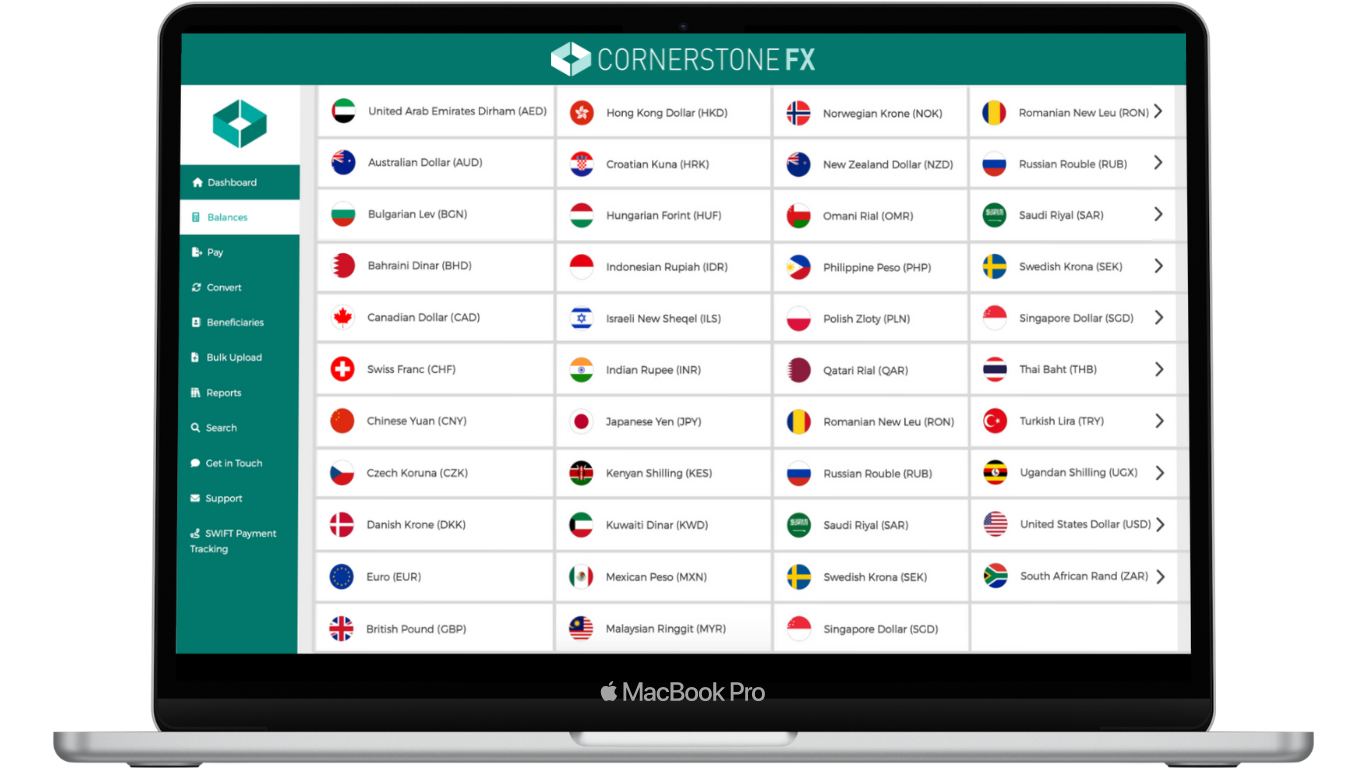

Exchange, send, collect and hold currency at ultra low and transparent rates of exchange, named multi-currency accounts, collect and hold funds worldwide from third-parties. Your complete solution for foreign currency management.

/ Why Cornerstone FX?

/ Take control of your payments

Named Multi-Currency Accounts

Get an EU IBAN, a UK sort code, and a US routing number in your company name.

Third Party Collections

Collect funds directly from customers all over the world, save time and eliminate costly bank transfers.

Ultra-Low, Transparent Margins

We offer ultra-low margins on currency conversions and offer complete transparency at all times.

Dedicated Relationship Manager

Your dedicated point of contact will take the time to understand your business and help you manage your FX exposure.

Same Currency Payments

Pay suppliers and staff from held currency. Save time and eliminate costly bank transfer fees.

Spot, Forward and Market Orders

Manage risk, from simple Spot Transfers, through to Forward Contracts, Market orders and hedging solutions.

/ Global solutions, local expertise

Local ACH, Fedwire and Swift details

Named local and international USD account details for fast payout and collection

Named Sepa and Swift account details

Sepa and Swift account details for local and international payout and collection

UK Faster Payments and Swift details

Both named UK Faster Payments and Swift details for ultra fast payout and collection

Named Local EFT and Swift details

Collect and send CAD locally, with named EFT details.

* Plus many other local payment and collection options, we support over 40 currencies, with payments to and from over 200 countries.

Security as standard

All client funds are fully safeguarded by our FCA-regulated e-money partners at a tier one credit institutions. Please find a link here to our terms and conditions detailing your full regulatory cover.

Tailored to your business

All Cornerstone clients are assigned their own dedicated Relationship Manager who will help you manage all aspects of your currency exposure, from spot trades to risk management strategies, and everything else in between. Manage your payments over the phone or online via your own dedicated platform.

Risk Management

We don't just offer spot conversions and payments, your Relationship Manager will be able to carry out a full diagnostic evaluation of your companies currency exposure and can also offer FX spot and forward contracts (up to 1 year), which can be used to mitigate foreign exchange risks.

Business Funding

We can facilitate a number of business financing options, such as trade and supplier financing.

Try us for free

Your first transfer with us up to the value of *£100,000 is completely free at the Interbank rate. Not only do you get to try us for free with absolutely no obligation going forward, the free transfer could potentially save your business thousands of pounds, compared to making the same transfer with your current bank or broker. Terms and Conditions apply.

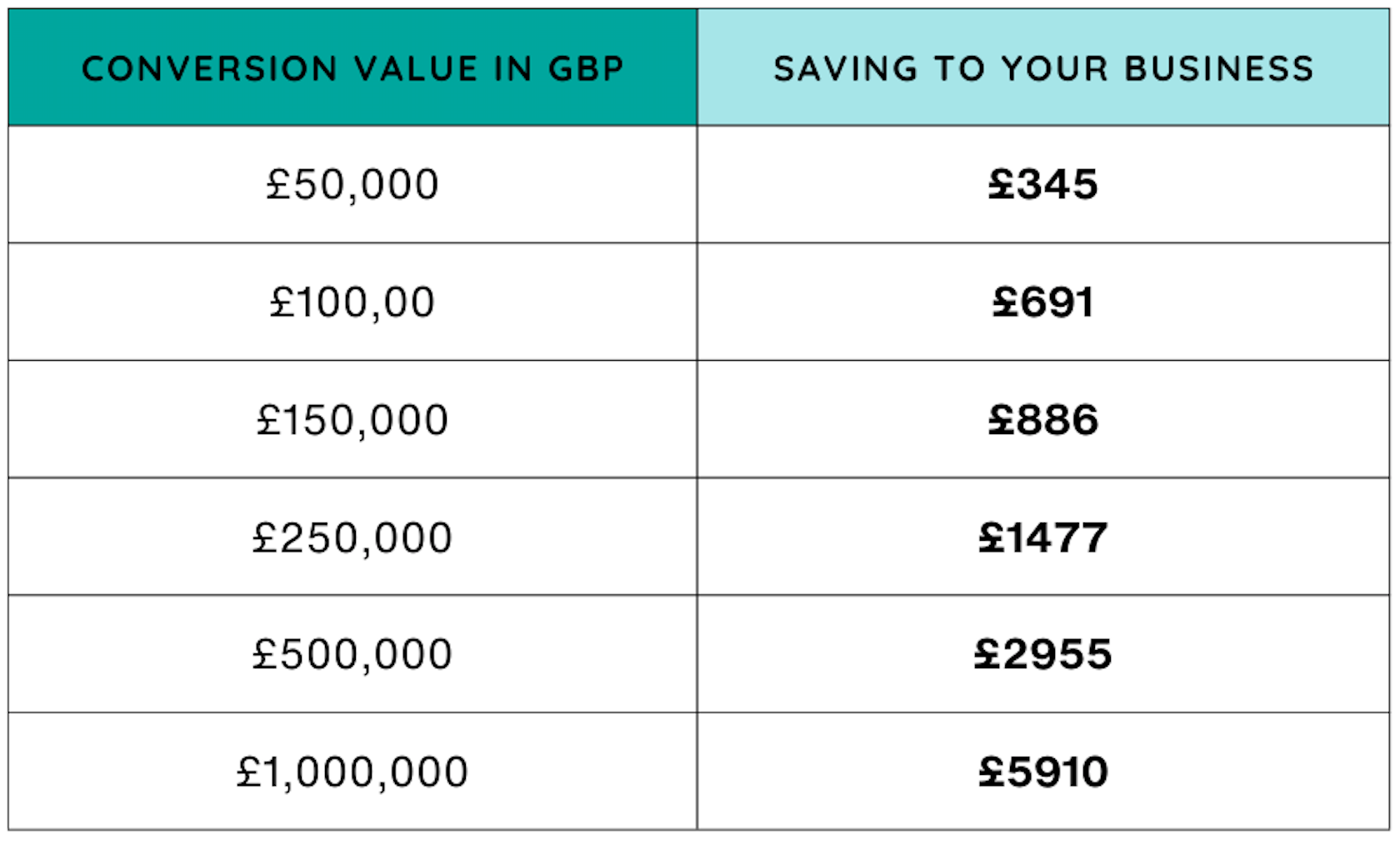

How much is the free transfer worth to your business?

Terms and Conditions of Free Transfer:

*Offer valid from 1st January 2024 to 5th April 2024. Offer valid on any currency conversion and to any country. Offer valid on a conversion up to the value of £100,000 GBP, or the equivalent in any other supported currency based on the conversion rate at the time. A nominal margin of 0.1% will be applied to all first transfers above the value of £100,000 GBP on the whole conversion amount and capped at £1,000,000 GBP. The offer is open to businesses only and not to private individuals. The offer is valid for spot contracts only, and not for forward contracts. For major currency pairs the margin applied will be the live market rate, for non-major and exotic currencies the margin applied will be the rate we receive from our liquidity providers, which in some cases may be lower than the published interbank rate. Free transfer does not cover costs out of our control, such as fees to settle funds to us, beneficiary bank fees or intermediary fees . Offer only open to customers making their first transfer with us.. As with any currency conversion, once entered into the free conversion forms a legally binding contract, if you fail to settle for the trade or wish to cancel it, you will still be liable for any loss to sell the currency back to the market at the prevailing rate. The savings table above is based on a margin of 0.691% which is derived from data taken from an independent monitoring company and based on margins applied across a number of FX brokers. Amounts above £100,000 GBP show saving, less our margin of 0.1%. Your actual margin may be higher or lower than 0.691%, therefore your actual saving may be higher or lower than the figures stated. All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

/ Committed to putting you first

We're also a fully certified Benefit Corporation, which means we’re part of a global community of businesses that meet the highest standards of social and environmental impact. It also involves making a legal commitment to always put you first, and an ambition to create a fairer financial system for all. This ultimately means lower costs and better service for you.

/ +44 (0) 208 004 2234

info@cornerstonefx.co.uk

UK Headquarters: 85 Great Portland Street, London, W1W 7LT

Email: info@cornerstonefx.co.uk

Cornerstone FX Ltd is a Limited company registered in England and Wales. Registered number: 12736110. Registered office: 85 Great Portland Street, London, W1W 7LT. Payment services for Cornerstone FX Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: The Steward Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited are fully authorised and regulated in the UK, EU, US, and Canada – Currencycloud are authorised and regulated by the FCA, registration number 900199, and FinCEN in 44 states. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). In the US Currency Cloud operates in partnership with CFSB. CFSB fully owns the bank program and services are provided by The Currency Cloud Inc. For clients based in the European Economic Area, payment services for Cornerstone FX are provided by CurrencyCloud B.V.. Registered in the Netherlands No. 72186178. Registered Office: Nieuwezijds Voorburgwal 296 - 298, Mindspace Nieuwezijds Office 001 Amsterdam. CurrencyCloud B.V. is authorised by the DNB under the Wet op het financieel toezicht to carry out the business of an electronic-money institution (Relation Number: R142701). For clients based in the United States, payment services for Cornerstone FX are provided by The Currency Cloud Inc. which operates in partnership with Community Federal Savings Bank (CFSB) to facilitate payments in all 50 states in the US. CFSB is registered with the Federal Deposit Insurance Corporation (FDIC Certificate #57129). The Currency Cloud Inc is registered with FinCEN and authorised in 39 states to transmit money (MSB Registration Number: 31000206794359). Registered Office: 104 5th Avenue, 20th Floor, New York , NY 10011.

For clients based in the United Kingdom and rest of the world, payment services for Cornerstone FX are provided by The Currency Cloud Limited. Registered in England and Wales No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). Some Payment Services for Cornerstone FX Ltd may also be provided by Equals Connect Limited, registered in England and Wales (registered no. 07131446). Registered Office: Vintners’ Place, 68 Upper Thames St, London, EC4V 3BJ. Equals Connect Limited are authorised by the Financial Conduct Authority to provide payment services (FRN: 671508) Some payment services for Cornerstone FX Ltd may also be provided by Sciopay Ltd. Sciopay Ltd is a company incorporated in England & Wales. Registration No: 12352935. Sciopay Ltd is licensed and regulated by HMRC as a Money Service Business (MSB). License No: XCML00000151326. Sciopay Ltd is authorised by the Financial Conduct Authority as an Authorised Payment Institution. Firm Reference Number: 927951